August 22, 2024

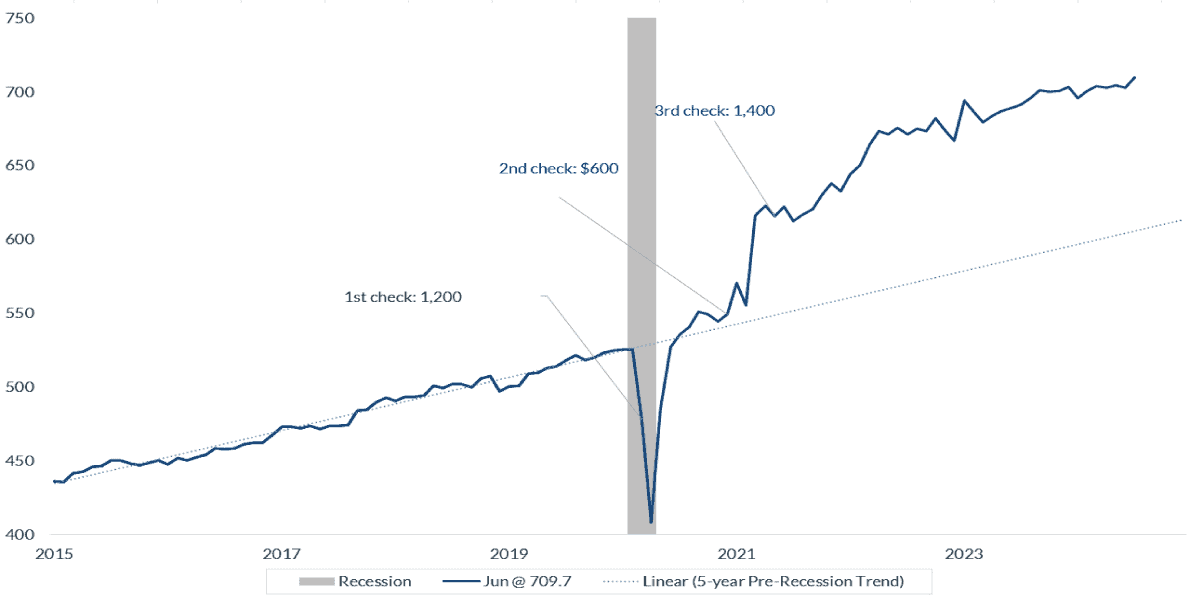

With high interest rates, have households slowed their pace of spending?

That is an important question since consumer spending accounts for roughly two-thirds of GDP. Consumer spending has been heading into some strong headwinds, most notably with the unemployment rate, which has increased in each of the past four months. The second quarter GDP showed consumption grew at a solid 2.3%. However, the question is focused on how the third quarter will play out.

Our only data so far is July’s retail sales report, which grew by 1.0% for the month, much stronger than the 0.2% monthly average of the previous twelve months.

This report is a reminder that the sky is not falling on the U.S. economy. It shows the continued resilience of consumer spending. This is important since the Fed is shifting its focus toward the labor market and away from inflation. Retail sales are somewhat of an extension of the health of the labor market – if workers are confident about their work and wage gains, they will continue to spend. So, this report helps offset the concerns of dwindling savings, high cost of credit, and smaller wage gains. Despite all that, the consumer has yet to tighten their financial belt.

Retail Sales

$, billions, seasonally adjusted

Source:U.S. Census Bureau, as of July 2024.

Information is subject to change and is not a guarantee of future results.

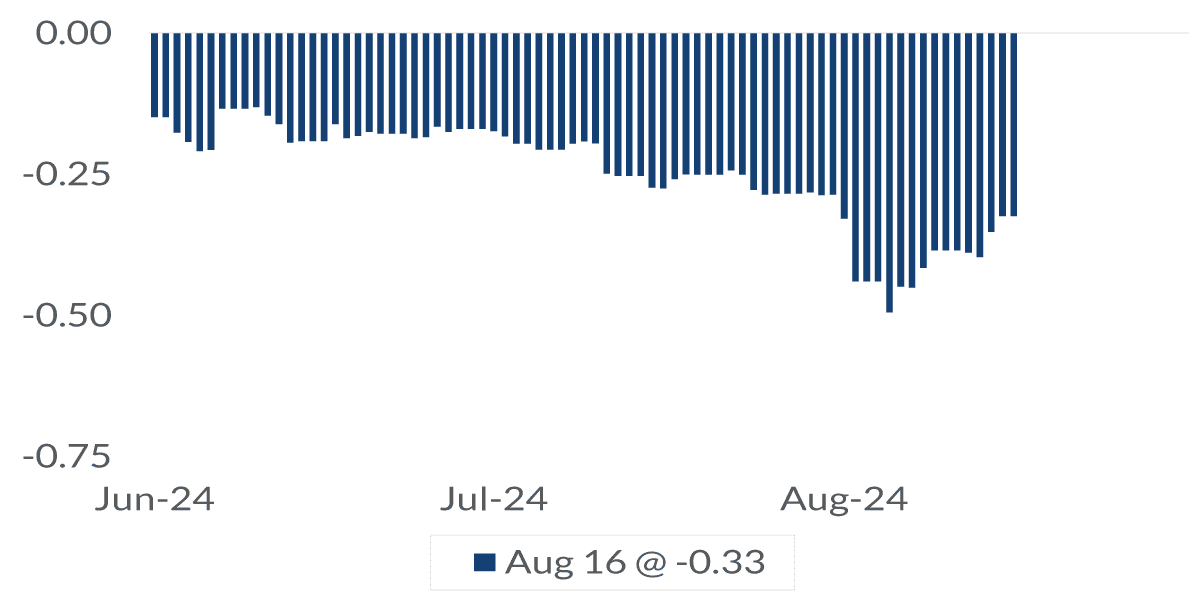

Will the Fed cut the federal funds rate by 25 or 50 basis points at its meeting in September?

With inflation appearing to be under control (CPI in the past three months has increased by just a 0.4% annual rate), it makes it easier for the Fed to shift its focus on the labor market and allow it the flexibility to respond aggressively, should it be needed.

Based on the federal funds futures market, the implied cut has been fluctuating between 25 and 50 bps, depending on the bullish or bearish read on recently released economic data. So, it is still a flip of a coin between the two.

For some time, CNR’s view has been a 25 bp cut. The Fed has a long history of 25 bps moves in the funds rate, especially when it initiates a change in direction. We believe a 50 bp cut would send the market the wrong message of urgency.

The strength/weakness of the August employment report will probably determine if the Fed cuts 25 or 50 bps.

The critical issue is that the Fed will start cutting interest rates after keeping them at 40-year highs for over a year.

Federal Funds Futures: September 2024

Implied Change from Current Rate

Source:Bloomberg’s WIRP page, as of August 16, 2024.

Information is subject to change and is not a guarantee of future results.

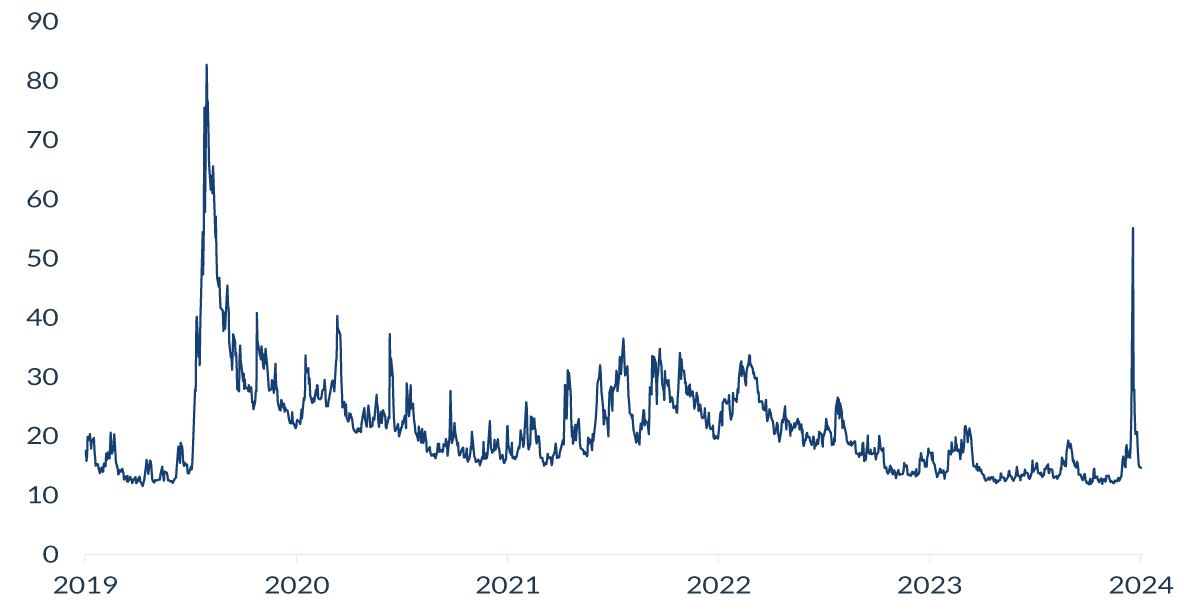

What is behind recent equity market volatility?

US equities have begun to bounce back from the recent market sell off and a sense of calm has returned to markets. The S&P 500 is up over xx% from the August 5 lows and the tech-heavy Nasdaq is up over xx%, while the VIX volatility index has settled at around 15, after spiking to 55.1, its highest level since March 2020. Market declines are never comfortable, and they can feel particularly jarring after a stretch like we’ve seen in 2024, with major US equity indexes repeatedly setting new highs. While we are not confident the spate of recent volatility fully run its course, we don’t believe it’s the start of a larger, deeper market decline.

Selling pressure began in earnest after a series of weaker than expected US jobs and activity data raised recessions, fears and concern that the Fed was waiting too long to cut interest rates. But the market sell-off was about more than weak economic data. Investor sentiment had become a bit frothy, particularly around tech stocks, leading to increased scrutiny around the payoffs for artificial intelligence investments. Weakness was further exacerbated by an unwinding of Yen carry trades and systematic/quantitative institutional investors unwinding leveraged bullish positions.

Over the past week, many of these conditions largely improved. Estimates suggest that about 75% of the Yen carry trade has now unwound, while the use of leverage is likely to decrease going forward as global rates settle at higher levels compared to the past decade. Markets also have found support from largely positive Q2 earnings results that cleared a high expectation bar. Most importantly though, resilient incoming consumer spending and jobs data, alongside a continued moderation in inflation pressures, has gone a long way toward easing economic growth concerns.

We think a slower but positive pace of GDP growth, broadening earnings growth and a coming Fed easing cycle should keep a reasonably sturdy foundation in place for financial markets to build upon. However, market volatility will likely remain high through the rest of the year. With valuations again back to elevated levels, more pressure will be placed on companies to deliver firm earnings growth over coming quarters. Meanwhile, geopolitical risk factors, and uncertainty around the U.S. election, could disrupt positive trends at any point.

CBOE Volatility Index

Sources: FRED data, as of August 2024.

CBOE: Chicago Board Options Exchange

Information is subject to change and is not a guarantee of future results.

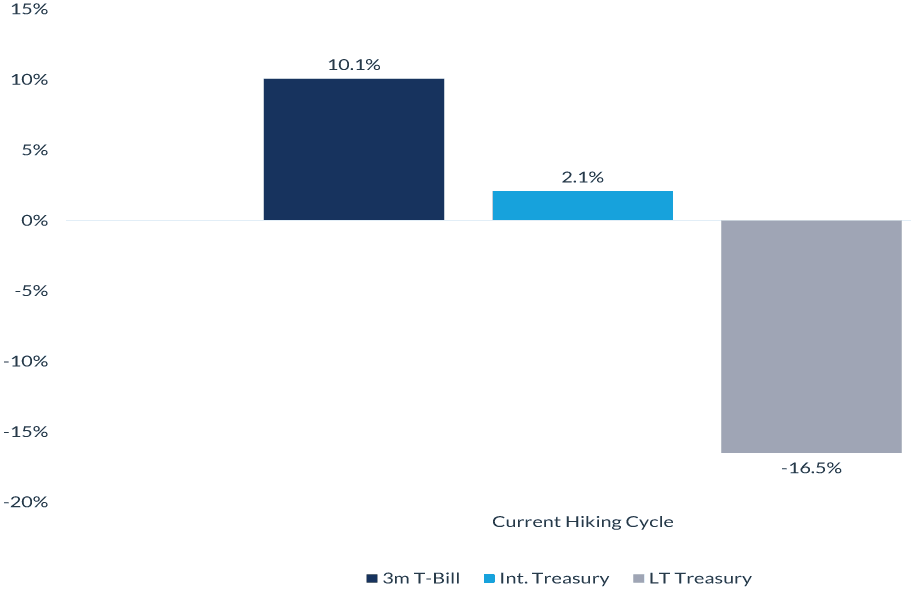

What Happens to T-Bill Yields When the Fed Starts Cutting?

For the better part of two years, investors have been able to earn more than 5% by stowing their cash in US Treasury Bills. The discount government notes offer (effectively) risk-free yields that haven’t been this high since before the Great Financial Crisis in 2008, and have returned more than +10% since the Federal Reserve began raising rates in 2022. Compare that to +2% returns for intermediate-term Treasuries and -17% returns for long-term Treasuries and it is easy to see why investors have favored short maturity securities.

US Government Bond - Total Return

(Current Fed Hiking Cycle)

Source: Bloomberg, as of August 2024.

Information is subject to change and is not a guarantee of future results.

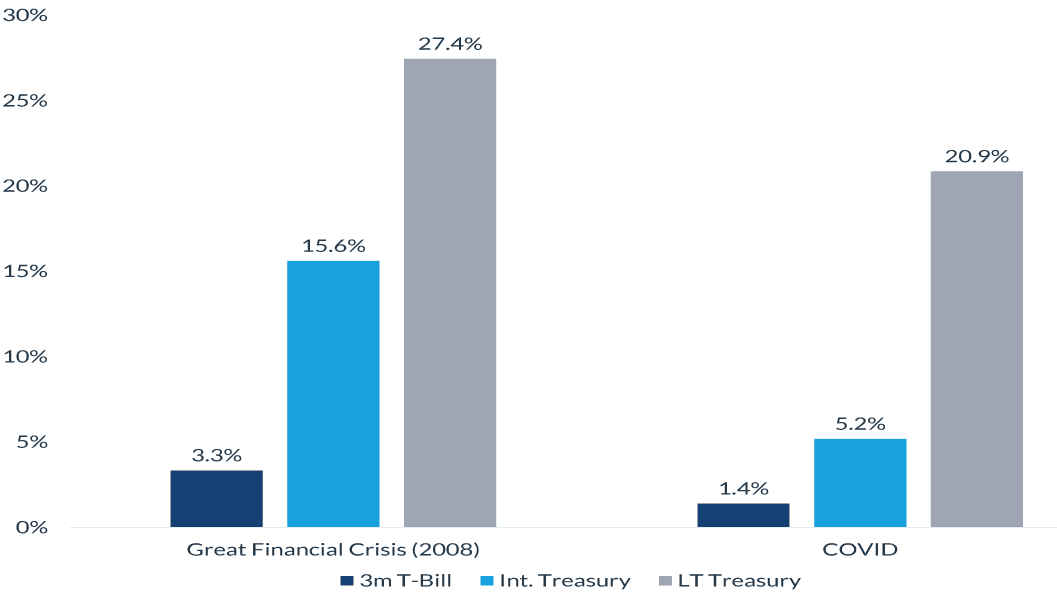

Short-term rates cannot remain elevated forever, and as the Federal Reserve continues to make progress in its fight against inflation, it will eventually begin to lower its policy rate. Both CNR and the broader market expect that process to begin in September of this year and continue at a steady pace through 2025.

As short-term rates fall, investors concentrated in short-term bonds will expose themselves to “reinvestment risk” – the concept that maturing securities will have to be reinvested at lower and lower rates. This inertia has the potential to cause significant underperformance to longer-duration securities, which benefit during periods of slower economic growth. The Fed’s rate cutting cycles during the Great Financial Crisis and COVID display this phenomenon clearly.

US Government Bond - Total Return

(Last Two Fed Cutting Cycles)

Source: Bloomberg, as of August 2024.

Information is subject to change and is not a guarantee of future results.

With lower inflation readings, moderating economic growth and a normalizing labor market, we believe now is a good time to discuss extending fixed income duration within client portfolios (as appropriate), particularly for investors who have parked idle cash into short-term Treasury bills. Though longer-term yields are still below shorter-term yields, forgoing a few extra basis points of return to “lock in” good yields over the next several years is the prudent investment decision.

IMPORTANT INFORMATION

The views expressed represent the opinions of City National Rochdale, LLC (CNR) whichare subject to change and are not intended as a forecast or guarantee of future results.Stated information is provided for informational purposes only, and should not beperceived as personalized investment, financial, legal or tax advice or a recommendation ofany security. It is derived from proprietary and non-proprietary sources which have notbeen independently verified for accuracy or completeness. While CNR believes theinformation to be accurate and reliable, we do not claim or have responsibility for itscompleteness, accuracy, or reliability. Statements of future expectations,estimates,projections, and other forward-looking statements are based on available information andmanagement's view as of the time of these statements. Accordingly, such statements areinherently speculative as they are based on assumptions which may involve known andunknown risks and uncertainties. Actual results, performance or events may differmaterially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As withany investment strategy, there is no guarantee that investment objectives will be met andinvestors may lose money. Diversification does not ensure a profit or protect against a lossin a declining market. Past performance is no guarantee of future performance.

Equity securities. There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed Income securities. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

High yield securities. Investments in below-investment-grade debt securities, which are usually called “high yield” or “junk bonds,” are typically in weaker financial health. Such securities can be harder to value and sell, and their prices can be more volatile than more highly rated securities. While these securities generally have higher rates of interest, they also involve greater risk of default than do securities of a higher-quality rating.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

©2024 City National Rochdale

INDEX DEFINITIONS

S&P 500 Index: The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market cap because there are other criteria that the index includes.

Bloomberg Investment Grade Municipal Index: The Bloomberg Municipal Index measures the performance of the Bloomberg U.S. Municipal bond market, which covers the USD- denominated Long-Term tax-exempt bond market with four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Bloomberg Municipal High Yield Bond Index measures the performance of non-investment grade, US dollar-denominated, and non-rated, tax-exempt bonds.

The Bloomberg U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market.

MSCI EAFE Index. The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the US and Canada.

DEFINITIONS

CPI: A consumer price index (CPI) is a price index; i.e., the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Yield to worst (YTW): Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

| Non-deposit investment Products are: • not FDIC insured • not Bank guaranteed • may lose value |

Stay Informed.

Get our Insights delivered straight to your inbox.

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here