March 2024 Market Update

A Deep Dive into CNR’s Economic and Investment Outlook

March 28, 2024

March 28, 2024

Optimism about U.S. Economic Continues

Spring 2024 arrived with a sunny outlook for the U.S. economy. The risk of a recession has dropped to 30%, while the likelihood of a soft landing rose to 70% for 2024, according to our leadership team at City National Rochdale. We anticipate the Fed to lower interest rates two or three times in 2024 beginning in the second half of the year, which is similar to the consensus of other economic analysts. The Fed is showing increased tolerance for a higher level of inflation with the view that it will move down later in 2024 and in 2025.

While we expect consumer spending to slow somewhat in 2024 after strong third and fourth quarters in 2023, the ongoing wealth effect of higher savings during the pandemic, the strength of the labor market and real income gains continue to demonstrate the resilience of the U.S. economy.

Our investment strategy continues to focus on high quality U.S. stocks and bonds. We anticipate modest returns across all asset classes in 2024 and believe clients looking for additional capital appreciation may want to consider mid-small cap equities.

Our estimates for GDP were raised from February’s estimates to 1.5% to 2.25% in 2024, and our estimates for corporate profit were also increased to 9% to 12%.

Several of our CNR Speedometers®, which are forward-looking economic indicators of six to nine months, are now in green territory and others, while still in yellow territory, also shifted more positive. Improving economic conditions drove our outlook for consumer sentiment, consumer spending, inflation and labor markets to positive territory. Business outlook and spending surveys improved.

Source: Proprietary opinions based on CNR Research, as of March 2024.

Information is subject to change and is not a guarantee of future results.

This information has been updated and is highlighted in the latest Speedometers video, located here: https://www.cnr.com/insights/speedometers.html

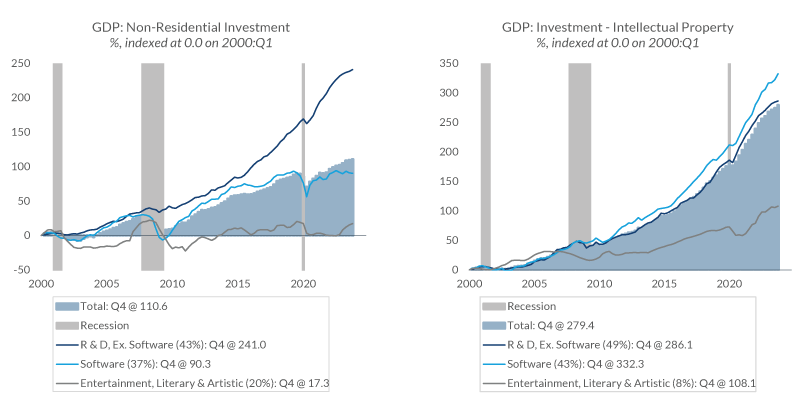

Intellectual property is vital to the economy since it promotes innovation, which leads to economic growth, and as a growing component of GDP, accounts for 43.1% of all non-residential investment. In the past few years, IP’s growth has been powered by copyrights and patents in the tech sector.

Data current as of March 27, 2024.

Source: Bureau of Economic Analysis.

Information is subject to change and is not a guarantee of future results.

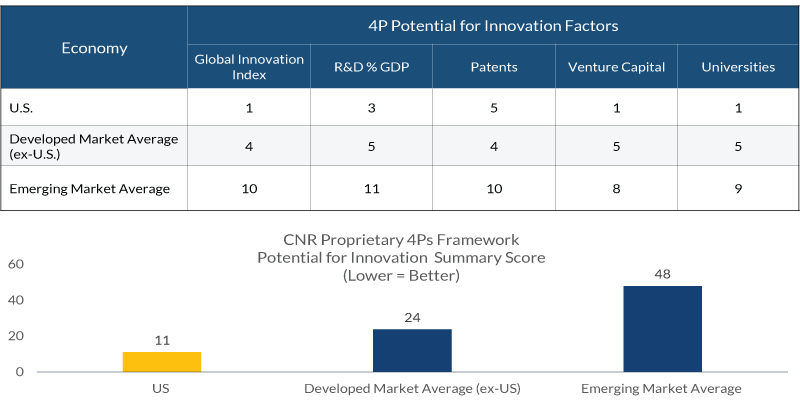

CNR’s proprietary “4Ps” framework seeks to identify the best opportunities for global equity investing over the coming decade. One of the advantages the U.S. has over other global economies is in its Potential for Innovation. The U.S. scores high in this 4P factor given its level of investment in research and development as a percentage of GDP, patent creation, availability of venture capital, quality of universities and its placement on the global innovation index.

Source: CNR Research, as of March 2024. CNR 4Ps: Policy, Profitability, Population and Potential.

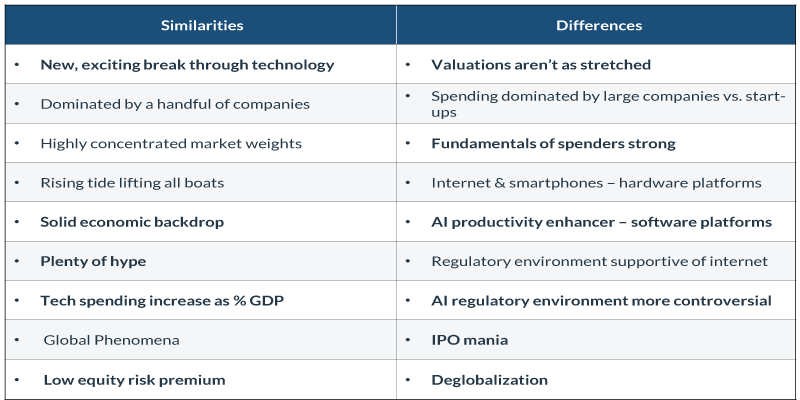

The dominance of the “Tech Titans” in the market concerns some investors who wonder if another dot.com bubble is occurring. While there are similarities between today and the dot.com years, there are numerous differences as well. In 2023, the differences in trends grew because of a stronger than expected economy, the continued influence of ETFs and equity derivative trades, and Microsoft’s massive investment in generative AI.

Source: CNR Research, as of March 2024.

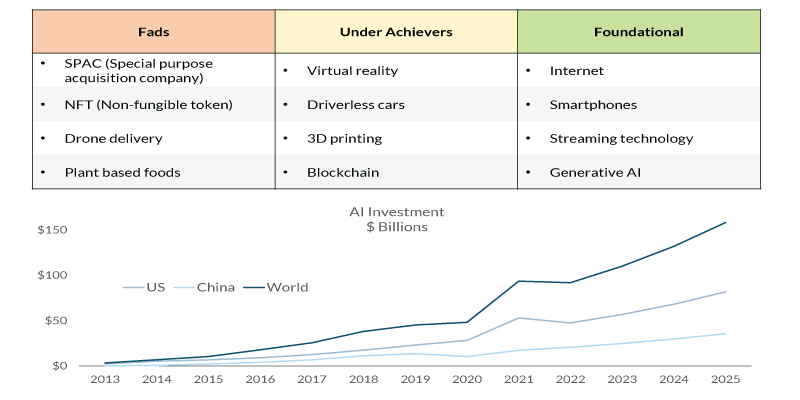

The key to successful long-term investing in technology is to identify and focus on foundational tech such as the internet and smartphones rather than on fads. Investment in generative AI is anticipated to increase, particularly in the U.S.

Sources: Goldman Sachs, CNR Research, as of March 2024.

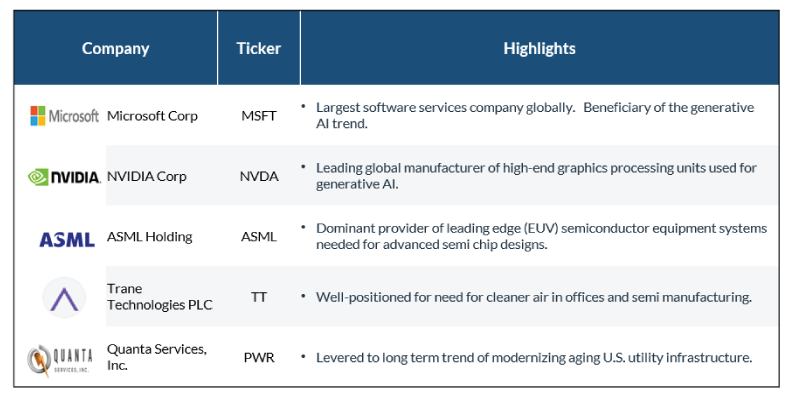

CNR’s Core Equity Portfolio invests in high quality companies with strong management teams, selling at reasonable valuations, and also looks for durable franchises with strong cash flow, good earnings visibility and growth prospects. Our investments include companies well-positioned for strategically important technology related spending initiatives.

Source: CNR Research, March 2024.

The information provided above is the investment opinion of CNR at the time of this presentation. There is no guarantee that the opinions will remain the same in the future and CNR is under no obligation to update the information.

The mention of any particular security should not be construed as a recommendation to buy or sell. Information is subject to change and is not a guarantee of future results.

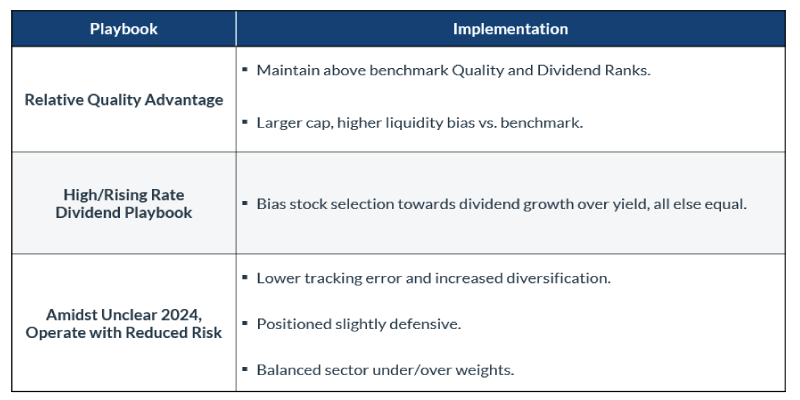

CNR’s recent repositioning in its equity income strategy investments focuses on quality companies with the tools and experience to avoid dividend cuts. Emphasis has shifted toward dividend growth over dividend yield compared to a few years ago for stocks that are otherwise equally attractive.

Source: Bloomberg, as of March 2024. Tracking error lowered from 3.67 to 2.83 from 5/31/23 (implementation of MAC3 Bloomberg Risk Model) to 2/29/24. Balanced sector weightings refers to reduction in Industry Rick Comparison (from 11.3 to 5.59 from 5/31/23 to 2/29/24).

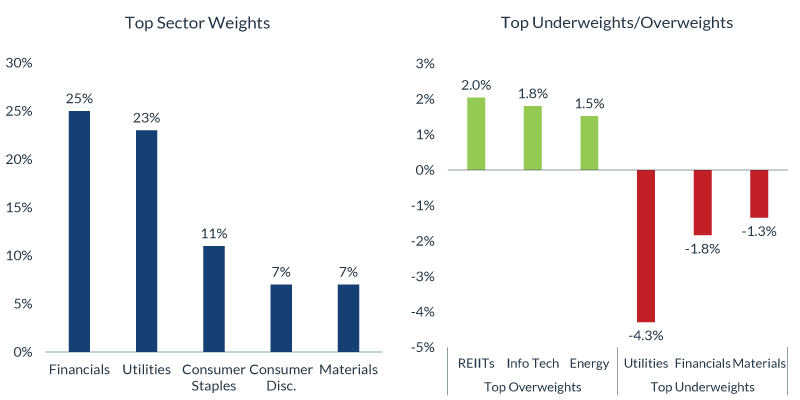

CNR’s recent trades in our equity income strategy remain focused on high quality companies with resilient and growing cash flows while reducing their modestly defensive tilt closer to neutral. We are overweight in the REIT, information technology and energy sectors, and underweight in utilities, financials and materials.

Source: FactSet, as of March 2024. Information is subject to change and is not a guarantee of future results.

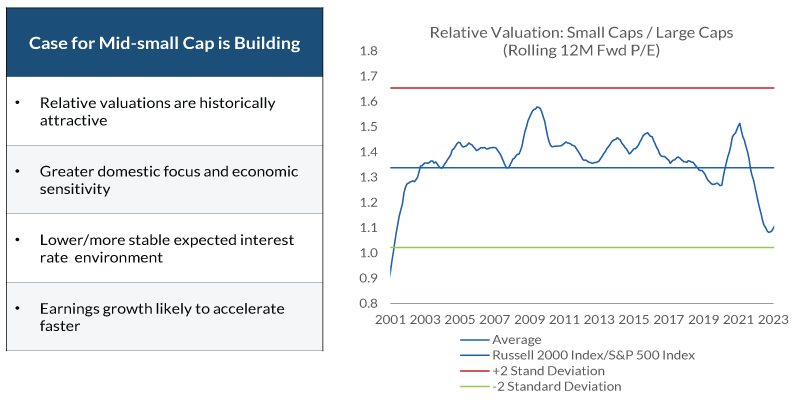

For investors looking for greater capital appreciation, mid-small cap stocks are becoming more attractive and could outperform large cap stocks. Mid-small cap stocks tend to outperform in a normal or stabilizing interest rate environment and their relative earnings growth has a greater upside potential. In addition, smaller cap stocks have greater exposure to the U.S. economy, while large cap stocks tend to be more multinational.

Source: FactSet, as of March 2024. Information is subject to change and is not a guarantee of future results.

Review Your Portfolio with Your Financial Advisor Today

City National Rochdale encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Important Information

Equity investing strategies & products.There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed Income investing strategies & products.There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall.This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

Investing in international markets.There are inherent risks with international investing. These risks include, but are not limited to, risks such as currency fluctuation, regulatory risks, and economic and political instability. Emerging markets involve heightened risks related to the same factors, as well as increased volatility, lower trading volume and less liquidity. In addition, emerging markets can have greater custodial and operational risks and less developed legal and accounting systems than developed markets. Investments in emerging markets bonds may be substantially more volatile, and substantially less liquid, than the bonds of governments, government agencies, and government-owned corporations located in moredeveloped foreign markets.

High yield securities.Investments in below-investment-grade debt securities, which are usually called “high yield” or “junk bonds,” are typically in weaker financial health. Such securities can be harder to value and sell, and their prices can be more volatile than more highly rated securities. While these securities generally have higher rates of interest, they also involve greater risk of default than do securities of a higher-quality rating.

Real estate sector or REITs.Concentrating assets in the real estate sector or REITs may disproportionately subject a portfolio to the risks of that industry, including the loss of value because of adverse developments affecting the real estate industry and real property values. Investments in REITs may be subject to increased price volatility and liquidity risk; concentration risk is high.

Municipal securities. The yields and market values of municipal securities may be more affected by changes in tax rates and policies than similar income-bearing taxable securities. Certain investors' incomes may be subject to the Federal Alternative Minimum Tax (AMT), and taxable gains are also possible.

Investments in the municipal securities of a particular state or territory may be subject to the risk that changes in the economic conditions of that state or territory will negatively impact performance. These events may include severe financial difficulties and continued budget deficits, economic or political policy changes, tax base erosion, state constitutional limits on tax increases and changes in the credit ratings.

All investment strategies have the potential for profit or loss; changes in investment strategies, contributions or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client's investment portfolio.

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based-on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

City National Rochdale, LLC, is a SEC-registered investment adviser and wholly owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank and City National Rochdale are subsidiaries of Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale, LLC.

© 2024 City National Rochdale, LLC. All rights reserved.

Index Definitions

S&P 500 Index. The Standard & Poor’s 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

MSCI EAFE Index. The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the US and Canada.

The MSCI Emerging Markets Index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes.

US High Yield Index. The US High Yield Index is a market capitalization weighted index that measures the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

Emerging Market High Yield. The MSCI Emerging Markets Index is a selection of stocks that is designed to track the financial performance of key companies in fast-growing nations.

Bloomberg US Corporate High Yield Index. The Bloomberg US Corporate High Yield Index measures the performance of non-investment grade, US dollar-denominated, fixed-rate, taxable corporate bonds.

Bloomberg Municipal Bond Index. The Bloomberg US Municipal Bond Index measures the performance of investment grade, US dollar-denominated, long-term tax-exempt bonds.

Bloomberg Municipal High Yield Bond Index. The Bloomberg Municipal High Yield Bond Index measures the performance of non-investment grade, US dollar-denominated, and non-rated, tax-exempt bonds.

Bloomberg US Corporate 1-5 years Total Return Index Value Unhedged USD: The Bloomberg US Corporate Bond 1-5 Year Index measures the investment grade, fixed-rate, taxable corporate bond market with 1-5 year maturities.

Bloomberg US Investment Grade Corporate Bond Index: The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

DJ US Select Dividend Index®. The Dow Jones US Select Dividend Index® measures the performance of the top 100 US stocks by dividend yield.

Bloomberg US Aggregate Bond Index: The Bloomberg US Aggregate Bond Index measures the performance of investment grade, US dollar-denominated, fixed-rate taxable bonds.

Bloomberg U.S. High Yield Corporate Bond Index. The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

The Bloomberg Investment Grade Corporate Bond Index .The Bloomberg US Investment Grade Corporate Bond Index measures the performance of investment grade, corporate, fixed-rate bonds with maturities of one year or more.

Bloomberg Emerging Market High Yield Index. The Bloomberg Emerging Markets USD Aggregate Bond Index is a flagship hard currency Emerging Markets debt benchmark that includes fixed and floating-rate US dollar-denominated debt issued from sovereign, quasi-sovereign, and corporate EM issuers.

Alternatives – Income based performance: Returns illustrated are 50% Palmer Square BB CLO Index/50% Palmer Square BBB CLO Index.

Nasdaq. Nasdaq 100 Index is an index composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

Indexes are unmanaged and do not reflect a deduction for fees or expenses. Investors cannot invest directly in an index.

Definitions

Commercial and Industrial (C&I) Loan A commercial and industrial (C&I) loan is a loan made to a business or corporation.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The Consumer Price Index (CPI) measures the monthly change in prices paid by US consumers.

Yield to Worst (YTW) is the lower of the yield to maturity or the yield to call. It is essentially the lowest potential rate of return for a bond, excluding delinquency or default.

A leveraged loan is a type of loan that is extended to companies or individuals that already have considerable amounts of debt or poor credit history.

A collateralized loan obligation (CLO) is a single security backed by a pool of debt.

CITY NATIONAL ROCHDALE, LLC NON- DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE