January 2024 Market Update

A Deep Dive into CNR’s Economic and Investment Outlook

January 25, 2024

January 25, 2024

Risks to Economic Outlook More Balanced

After two years of economic, geopolitical and market volatility, the outlook for 2024 is improved, according to the leadership team at City National Rochdale. With economic growth remaining stronger than expected and inflation moderating, CNR has lowered their risk of a mild recession to 50%. However, they believe financial markets have gotten somewhat ahead of themselves as we start 2024, and are too aggressive in their expectations of Fed rate cuts. CNR anticipates the Fed will lower interest rates in 2024, but a more modest two or three times beginning in the second half of the year.

CNR expects modest returns across asset classes in 2024 and remains focused on investing in high-quality stocks and bonds. Corporate profit expectations, inflation and Fed policy will likely remain key drivers of financial markets, and while the backdrop for all three should improve over the course of the year, uncertainty around the extent and timing is likely to create volatility as well as better buying opportunities in the coming months.

• Indicators improving, risks to outlook growing more balanced.

• Fed likely done with rate hikes, headwinds expected to moderate.

• Consumer remains resilient, but slower spending ahead likely.

• Expecting improvements in corporate profits, inflation and credit conditions.

• Geopolitical events remain key risk to outlook.

Source: Proprietary opinions based on CNR Research, as of January 2024.

Information is subject to change and is not a guarantee of future results.

Several of CNR’s Speedometers®, which are six- to nine-month forward-looking economic and financial market indicators, improved over the past month. Dials for the U.S. economic outlook, housing and mortgages, business outlook and spending, corporate profits, inflation, and credit demand and availability all moved in a positive direction.

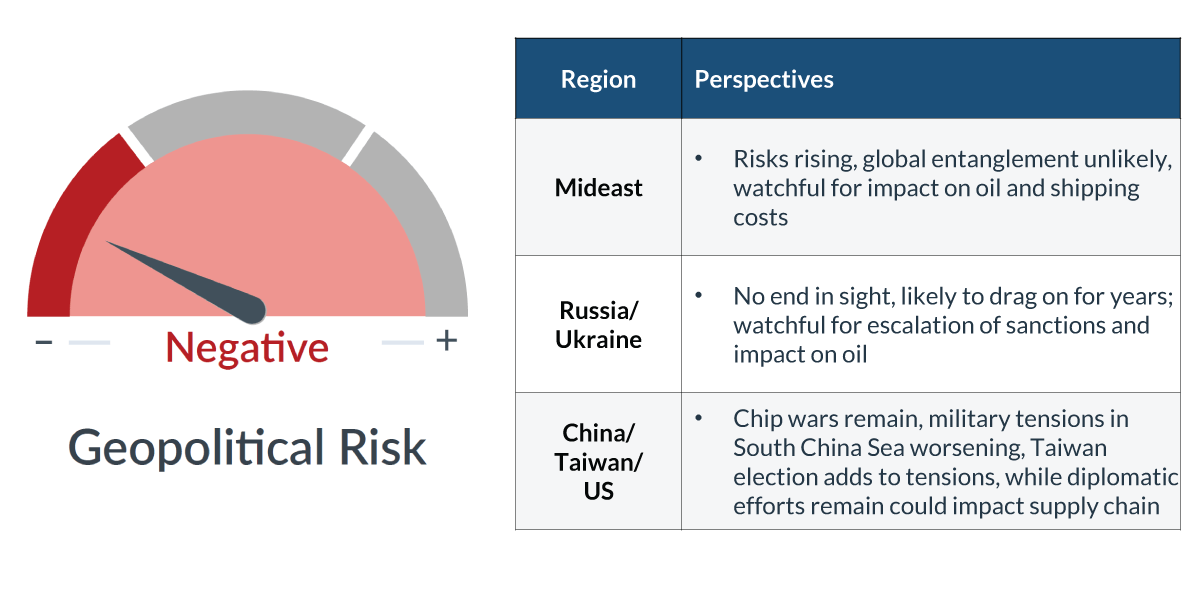

While CNR continues to monitor geopolitical risk, absent some exogenous shock, they don’t expect global tensions to have a material impact U.S. economic activity. Elections in the U.S. and around the globe are expected to be contentious, but are not anticipated to significantly affect U.S. economic activity or market performance.

Source: Source: Factset, as of January 2024.

Presidential election years typically see strong performance in the S&P 500, and over the long run, equities have historically performed well regardless of which political party is in control of government. Markets tend to be much more influenced by factors such as interest rates, Fed policy direction and corporate profit growth.

Source: CNR Research, as of January 2024.

Rather than domestic politics, CNR is more concerned about the impact that geopolitical risks pose on economic activity. Geopolitical risks are leading to increased economic policy uncertainty. They are closely watching the Mideast for a potential impact on oil prices and shipping, along with China because of ongoing chip wars and tensions with Taiwan.

Data current as of January 24, 2024 Source: Bureau of Labor Statistics Information is subject to change and is not a guarantee of future results.

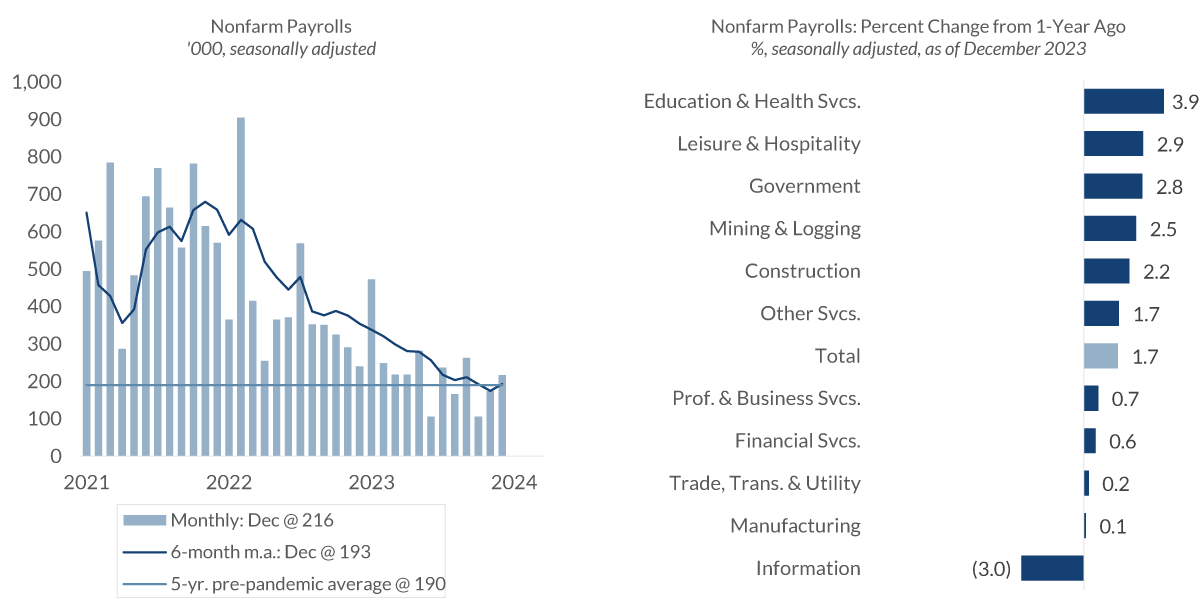

A slower period of job growth is likely in the months ahead, but overall employment is expected to be supported by gains in the education, healthcare and government sectors that are still playing catch-up from the pandemic. A normalization in the labor market should also lead to a slowdown in income increases after years of strong wage growth, helping to further reduce inflationary pressures.

Data current as of January 24, 2024 Source: Federal Reserve Information is subject to change and is not a guarantee of future results.

A slowdown in bank lending contributed to predictions that the U.S. might be heading into a recession, but bank lending began to pick up in the middle of 2023 and is an important signal of potential future growth.

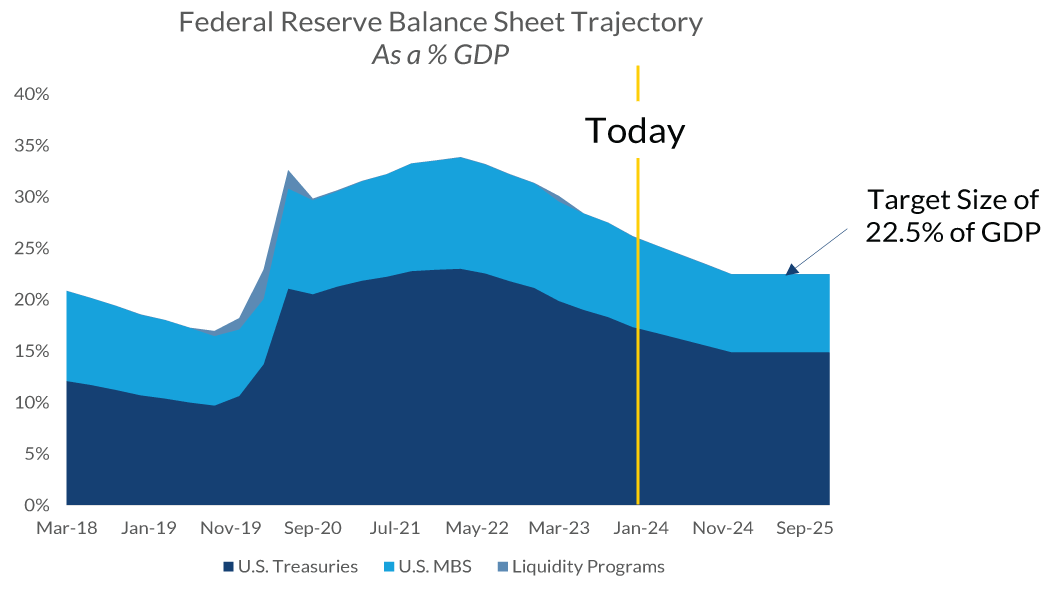

Source: Bloomberg, Federal Reserve, CNR. As of January 2024. Represents Federal Reserve Assets as a percentage of GDP on a quarterly basis. Projections calculated based on a target balance sheet size of 22.5%, in-line with the previous reduction over 2019 and assuming pro-rata reductions of U.S. Treasuries, Mortgage-Backed Securities and Liquidity Programs.

Recent volatility in some fixed income markets has increased the focus on the Fed’s balance sheet reduction process. CNR anticipates tapering of the Fed’s balance sheet will moderate and stop entirely by the end of 2024.

As of January 2, 2024. Source: NAREIT, Bloomberg, Dallas Federal Reserve.

Although risks remain in Commercial real estate, the percentage of loans going bad peaked in the third quarter of 2023, and we think commercial real estate will strengthen in 2024 and there should be more transactions.

Source: Bloomberg, CNR. As of January 22, 2024. Indexes used: Bloomberg Emerging Market High Yield Index; Bloomberg U.S. High Yield Corporate Bond Index.

While no allocation changes have been made, CNR’s outlook is shifting on emerging market bonds. As the Fed cuts rates later in 2024, global easing is possible. That could be a good tailwind for emerging market bonds.

Source: Factset, as of December 2023. Information is subject to change and is not a guarantee of future results.

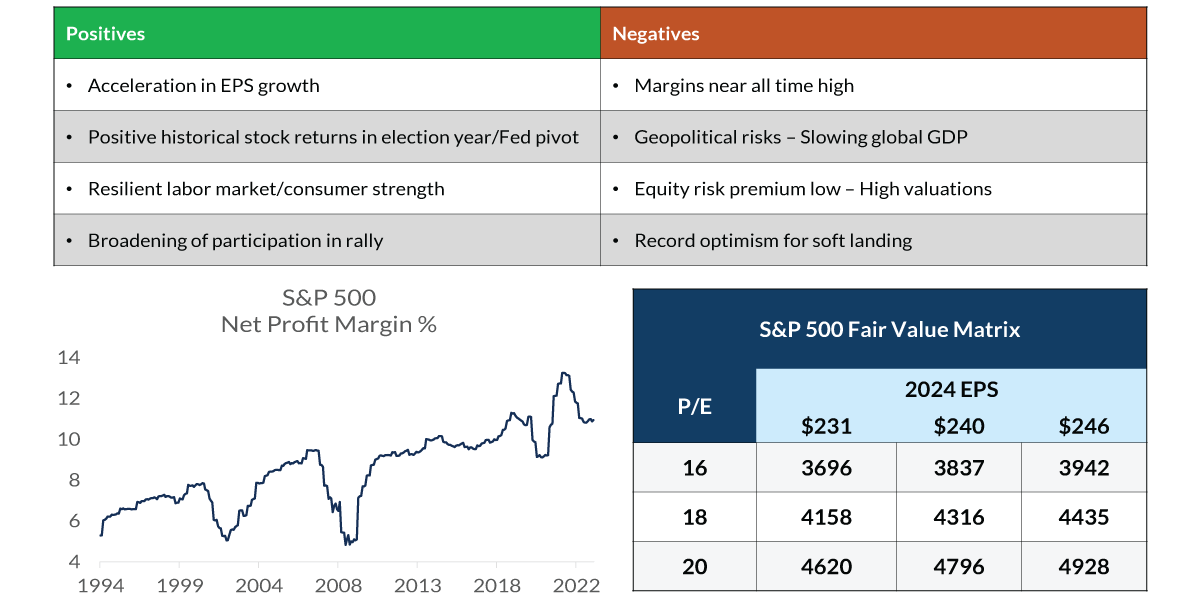

Given the expectation that the U.S. economy will continue to prove more resilient than Europe’s or Asia’s, CNR continues to favor U.S. stocks. On the positive side, they are seeing accelerating earnings per share growth, a resilient labor market and consumers, broader participation in the market rally beyond tech stocks, and a history of market strength in presidential election years. But they are watching some potential negative factors such as geopolitical risks, high valuations, margins near an all-time high, and potential over-optimism about a soft landing.

Source: CNR Research, as of December 2023. Information is subject to change and is not a guarantee of future results *Alternative investments are speculative, may entail substantial risks and may not be suitable for all investors.

Overall, CNR is expecting positive but more modest returns across asset classes in 2024.

Review Your Portfolio with Your Financial Advisor Today

City National encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Important Information

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification may not protect against market risk or loss. Past performance is no guarantee of future performance. Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.Equity investing strategies & products. There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

Investing in international markets. There are inherent risks with international investing. These risks include, but are not limited to, risks such as currency fluctuation, regulatory risks, and economic and political instability. Emerging markets involve heightened risks related to the same factors, as well as increased volatility, lower trading volume and less liquidity. In addition, emerging markets can have greater custodial and operational risks and less developed legal and accounting systems than developed markets. Investments in emerging markets bonds may be substantially more volatile, and substantially less liquid, than the bonds of governments, government agencies, and government-owned corporations located in more developed foreign markets.

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.CNR is free from any political affiliation and does not support any political party or group over another.

City National Rochdale, LLC, is an SEC-registered investment adviser and wholly owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank and City National Rochdale are subsidiaries of Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale, LLC.

Index Definitions

S&P 500 Index. The Standard & Poor’s 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

MSCI EAFE Index. The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the US and Canada.

Bloomberg US Corporate High Yield Index. The Bloomberg US Corporate High Yield Index measures the performance of non-investment grade, US dollar-denominated, fixed-rate, taxable corporate bonds.

Bloomberg Municipal Bond Index. The Bloomberg US Municipal Bond Index measures the performance of investment grade, US dollar-denominated, long-term tax-exempt bonds.

Bloomberg Municipal High Yield Bond Index. The Bloomberg Municipal High Yield Bond Index measures the performance of non-investment grade, US dollar-denominated, and non-rated, tax-exempt bonds.

Bloomberg US Corporate 1-5 years Total Return Index Value Unhedged USD: The Bloomberg US Corporate Bond 1-5 Year Index measures the investment grade, fixed-rate, taxable corporate bond market with 1-5 year maturities.

Bloomberg US Investment Grade Corporate Bond Index: The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

The Russell 2000® Index: is a market capitalization-weighted index measuring the performance of the small-cap segment of the US equity universe and includes the smallest 2,000 companies in the Russell 3000® Index.

DJ US Select Dividend Index®. The Dow Jones US Select Dividend Index® measures the performance of the top 100 US stocks by dividend yield.

Bloomberg US Aggregate Bond Index: The Bloomberg US Aggregate Bond Index measures the performance of investment grade, US dollar-denominated, fixed-rate taxable bonds.

Alternatives – Income based performance: Returns illustrated are 50% Palmer Square BB CLO Index/50% Palmer Square BBB CLO Index.

Indexes are unmanaged and do not reflect a deduction for fees or expenses. Investors cannot invest directly in an index.

Definitions:

Commercial and Industrial (C&I) Loan A commercial and industrial (C&I) loan is a loan made to a business or corporation.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The Consumer Price Index (CPI) measures the monthly change in prices paid by US consumers.

Yield to Worst (YTW) is the lower of the yield to maturity or the yield to call. It is essentially the lowest potential rate of return for a bond, excluding delinquency or default.

CITY NATIONAL ROCHDALE, LLC NON- DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE