October 2024 Market Update

A Deep Dive into CNR’s Economic and Investment Outlook

October 31, 2024

October 31, 2024

October Market Update Summary

In our October Market Update webinar, City National Rochdale (CNR) leaders, including Chief Investment Officer Charles Luke, Senior Economist, Senior Portfolio Manager Paul Single and Head of Fixed Income Michael Taila provided an update on what’s in store for the economy, financial markets and implications for client portfolios.

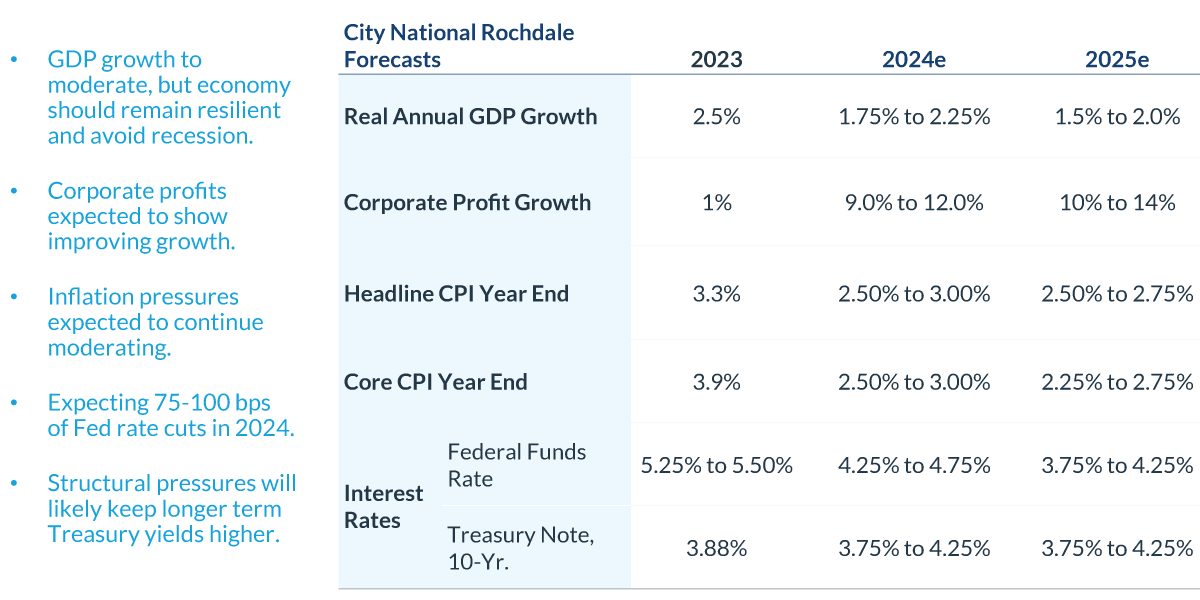

Charles Luke discussed the CNR market perspective, touching on how underlying fundamentals for the US economy remain strong. With inflation normalizing, the Fed is in the fortuitous position of being able to lower interest rates even though economic growth remains solid and the unemployment rate is still relatively low. Looking forward, the combination of easing financial conditions, strong corporate earnings and ongoing economic growth paints an optimistic backdrop for market returns as we head into the final months of 2024. While election uncertainties may introduce some short-term volatility, history suggests a quick recovery.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers.

e: estimate.

Sources: Bloomberg, proprietary opinions based on CNR Research, as of September 2024. Information is subject to change and is not a guarantee of future results.

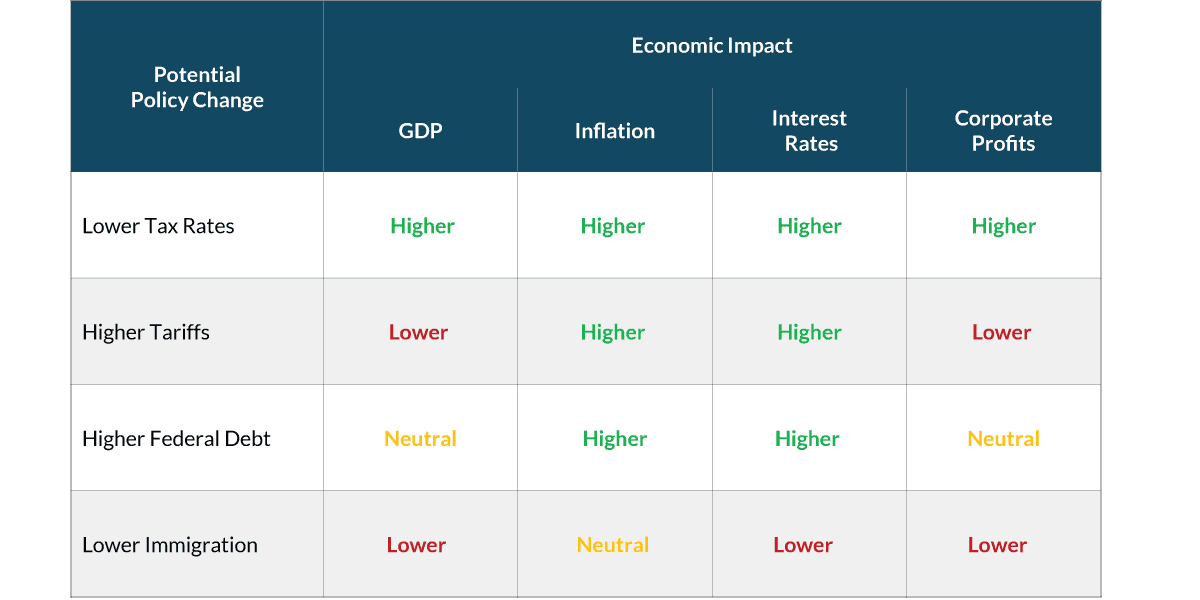

Regarding the 2024 election, CNR is focused on potential policy impacts in four main areas: taxes, tariffs, debt and immigration. Harris’s policy would be a continuation of existing policy, favoring clean energy and include more strategic tariffs that may benefit exporters and higher potential taxes may hurt capex heavy sectors. Trump’s policy changes would favor Financials and Energy, and domestic profits could favor Utilities and Real Estate sectors. Trade and Tax policy could lead to higher inflation and interest rates, and his policy may also increase growth. However, both platforms are likely to increase government debt.

Source: CNR Research, as of October 2024. Information is subject to change and is not a guarantee of future results.

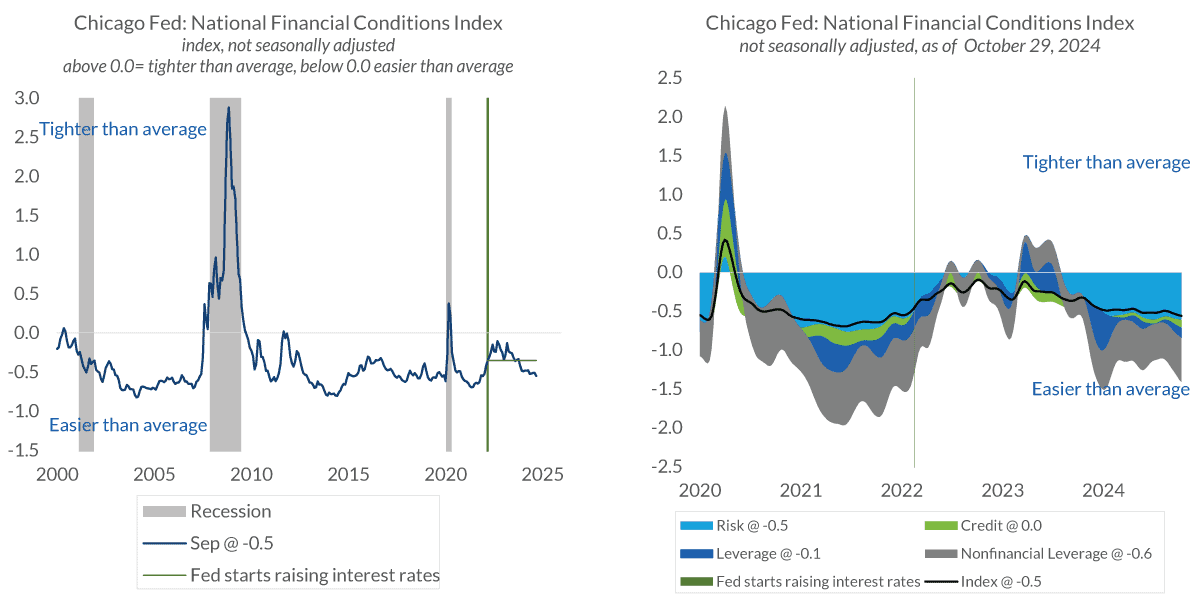

Paul Single gave an economic update, touching on how the expectation of continued robust consumer spending was boosted by revisions to income and spending. The Fed’s planned interest rate cuts should help reduce the cost of financing products that are of higher cost, and keep financial conditions easier than average. Additionally, reduced wage pressures should give the Fed confidence that the decline in inflation should be less sticky.

Data current as of October 29, 2024

Source: The Federal Reserve Bank of Chicago, Federal Reserve Bank

Information is subject to change and is not a guarantee of future results.

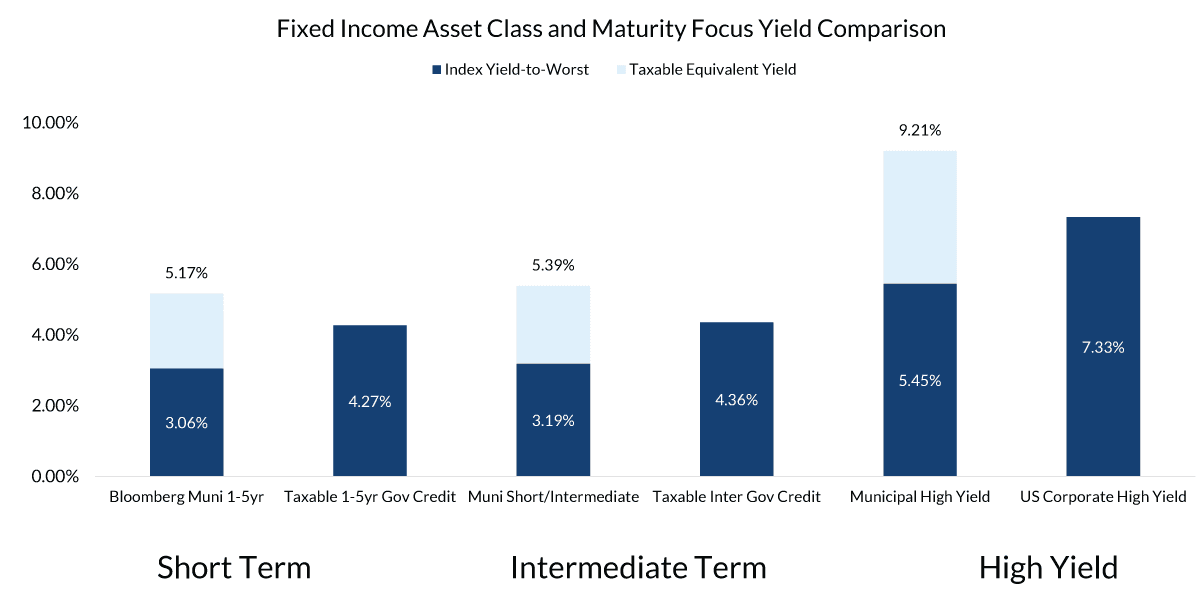

From the fixed income perspective, Michael Taila discussed that FOMC easing has been met with sharply higher yields. Economic and political forces to pressure longer term yields, while underlying credit fundamentals remain healthy. High levels of income can cushion return volatility and drive total returns, and market yields remain compelling.

Source: All data as of 10/23/2024. Bloomberg Municipal 1-5yr, Bloomberg Taxable 1-5yr Government Credit, Bloomberg Municipal Short/Intermediate, Bloomberg Taxable Intermediate Government Credit, Bloomberg Municipal High Yield, and Bloomberg US Corporate High Yield.

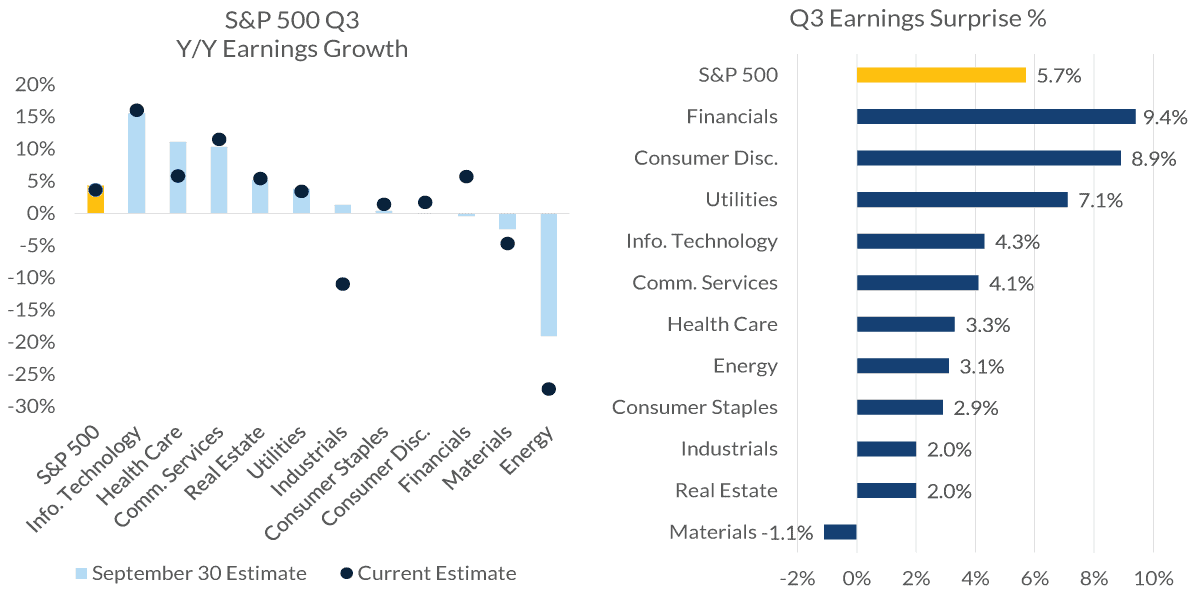

Charles Luke ended the presentation with an update on equities, noting how the stock market typically moves higher during Federal Reserve easing cycles, and stock market rotations have occurred but have not been sustainable. The market has broadened, evidenced by non-tech earnings and overall performance, and while aggregate valuation is high, we still believe sectors outside of Technology present opportunities. The start to Q3 earnings season has been slightly below expectations, but most of the drag has come from energy.

Source: FactSet, as of October 2024. Information is subject to change and is not a guarantee of future results.

Review Your Portfolio with Your Financial Advisor Today

City National Rochdale encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Index Definitions

The Standard & Poor’s 500 Index (S&P 500) is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity and industry group representation to represent U.S. equity performance.

The Bloomberg Barclays U.S. Corporate High Yield Index is an unmanaged, U.S.-dollar-denominated, nonconvertible, non-investment-grade debt index. The index consists of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million.

The Dow Jones U.S. Select Dividend Index aims to represent the US's leading stocks by dividend yield.

Bloomberg 60% Tax-Exempt High Yield/40% Municipal Investment Grade TR Index Unhedged 1% issuer cap: A custom index comprised 60% of the Bloomberg Municipal Bond High Yield Index TR Unhedged and 40% of the Bloomberg Municipal Bond Index TR Unhedged. The issuer cap is 1%.

The Bloomberg Aggregate Bond Index, or "the Agg," is a broad-based fixed-income index used by bond traders and managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

The Bloomberg 1-3 Month U.S. Treasury Bill Index (the "Index") is designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to one month and less than three months.

The Russell 2000 Index is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.

Definitions

6M T-Bills: The 6 Month Treasury Bill Rate is the yield received for investing in a U.S. government-issued treasury bill that has a maturity of six months.

Employment Index: U.S. jobs with the exception of farmwork; unincorporated self-employment; and employment by private households, the military, and intelligence agencies.

A collateralized loan obligation (CLO) is a single security backed by a pool of debt.

A consumer price index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. The CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically.

A leveraged loan is a type of loan that is extended to companies or individuals that already have considerable amounts of debt or poor credit history.

A high-yield bond, or junk bond, is a corporate bond that represents debt issued by a firm with the promise to pay interest and return the principal at maturity. Junk bonds are issued by companies with poorer credit quality.

Muni Bond: A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures, including the construction of highways, bridges or schools. These bonds can be thought of as loans that investors make to local governments.

Liquidity Management: The liquidity index calculates the days required to convert a company's trade receivables and inventory into cash.

Investment Grade Municipal Bonds: Investment-grade municipal bonds are debt securities, issued by state and local governments carrying the lowest credit risk that a bond issuer may default. Investment Grade Municipal Bonds: Bloomberg Municipal Bond Inter-Short 1-10 Year Total Return Index.

Investment Grade Corporate Bonds: Investment-grade corporate bonds are low-risk bonds. Because they are bonds, they are not tied to equity. Instead, they are like debt notes issued by a corporation. Investment Grade Corporate Bonds: Bloomberg Intermediate Corporate Bond Index.

The “core” Personal Consumption Expenditures (PCE) price index is defined as prices excluding food and energy prices. The core PCE price index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation.

The Producer Price Index (PPI) is a family of indexes that measures the average change over time in selling prices received by domestic producers of goods and services.

Municipal bonds (or “munis”) are a fixture among income-investing portfolios. Investors who want higher returns can invest in high yield municipal bonds.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Yield to Worst (YTW) is the lower of the yield to maturity or the yield to call. It is essentially the lowest potential rate of return for a bond, excluding delinquency or default.

CNR Speedometers® are indicators that reflect forecasts of a 6- to 9-month time horizon. The colors of each indicator, as well as the direction of the arrows, represent our positive/negative/neutral view for each indicator. Thus, arrows directed towards the (+) sign represent a positive view which, in turn, makes it green. Arrows directed towards the (-) sign represent a negative view which, in turn, makes it red. Arrows that land in the middle of the indicator, in line with the (0), represent a neutral view which, in turn, makes it yellow. All of these indicators combined affect City National Rochdale’s overall outlook of the economy.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR), which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources that have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy or reliability. Statements of future expectations, estimates, projections and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification may not protect against market risk or loss. Past performance is no guarantee of future performance.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.

CNR is free from any political affiliation and does not support any political party or group over another.

Equity investing strategies and products. There are inherent risks with equity investing. These risks include, but are not limited to, stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed income investing strategies and products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

High yield securities. Investments in below-investment-grade debt securities, which are usually called “high yield” or “junk bonds,” are typically in weaker financial health. Such securities can be harder to value and sell, and their prices can be more volatile than more highly rated securities. While these securities generally have higher rates of interest, they also involve greater risk of default than do securities of a higher-quality rating.

Municipal securities. The yields and market values of municipal securities may be more affected by changes in tax rates and policies than similar income-bearing taxable securities. Certain investors' incomes may be subject to the Federal Alternative Minimum Tax (AMT), and taxable gains are also possible. Investments in the municipal securities of a particular state or territory may be subject to the risk that changes in the economic conditions of that state or territory will negatively impact performance. These events may include severe financial difficulties and continued budget deficits, economic or political policy changes, tax base erosion, state constitutional limits on tax increases, and changes in the credit ratings.

© 2024 City National Rochdale, LLC. All rights reserved.

NON-DEPOSIT INVESTMENT PRODUCTS: • ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE